Unfortunately, there is no easy way to explain the PTET, especially the California one. But I will try. This blog will give you an overview of how the CA PTET works and it will also help you with filling out tax forms. Let's dive in.

How Does California PTET Work?

Example: Your small business made $100,000 after all expenses. You know that you are going to owe to California and need to make estimated payments for your personal California taxes. Traditionally, California estimated payments get paid from your personal funds and are not deductible. However, with the CA PTET you are allowed to pay a portion of these payments through your business and deduct these payments as an expense on your books. California gets its estimated payments. And you save some tax on federal level by deducting California taxes as a business expense. Everyone is happy.

What is the Formula of the CA PTET?

To understand how CA PTET works, let's look at the formula. The calculation is simple: it’s your business’s California-source income multiplied by 0.093. This amount represents the maximum you can pay using CA PTET (though you may choose to pay less). Where to get information on California income? You could take Profit and Loss statement and adjust it for California income and deductions. Using the same example, if you see that your California income is $100,000, then you are allowed to pay $9,300 in the Pass-Through Entity Tax.

How to Calculate Your Share of the CA PTET?

If you are not the only owner of your business, you will need to calculate your share of that. To do so, multiply the total CA PTET amount by your percentage ownership in the business.

How Does the CA PTET Flow Through My Tax Returns?

Here’s how the CA PTET works in relation to tax filings: First, a business deducts the CA PTET on its federal business return, which reduces the entity's federal taxable income. This reduced federal taxable income flows to the K-1 of the business owner and gets recorded on their personal tax return. As a result, the business owner pays less in federal taxes because of this deduction. However, on the California personal tax return, the CA PTET amount is added back to the income (through an add-on on the California K-1). This way California taxes the owner on the original income amount before the deduction.

When to Make the CA PTET Payment?

The entity must make two payments. The first payment is due by June 15 of the taxable year and is the greater of 50% of the elective tax paid for the previous year or $1,000. The remaining amount is due by the entity's original filing date deadline (March 15 for calendar-year taxpayers). If the June prepayment is underpaid, the taxpayer is ineligible to make the election for that taxable year.

How to Make an Election for the CA PTET?

To make an election, the first step is to make a payment prior to June 15 of the current year as I described above. You can do it on the FTB website or by mailing the voucher and a check.

When to Pay the CA PTET Tax?

The entity should deduct the tax in the year it is paid. However, even though you are allowed to wait till March 15th of the next year to make a final payment, it makes sense to make this payment in the end of December of the current year. This way you get a benefit of a deduction on current taxes. For example, if you paid the PTET tax in 2022 for the 2021 tax year, the payment would be only deducted on the entity's 2022 tax return and reflected on the 2022 K-1 form. The 2021 tax return will stay untouched. However, the California estimated payments for personal tax would still apply to the 2021 tax year.

How to Report a CA PTET Payment on California Business Return?

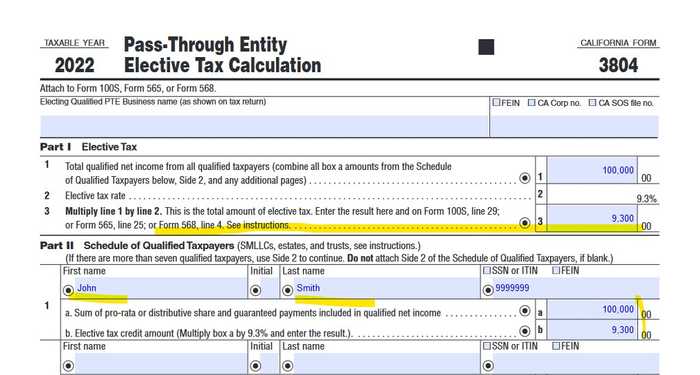

LLCs: Form 3804 should be attached to the business return and it should include the list of all owners ( if there are more than one) for whom the tax was paid. Keep in mind that once you have filed your original business tax return and the deadline for filing has passed, you cannot file another return to make, revoke, or modify the election amount.

You should also calculate the full amount of the CA PTET tax on line 3. See below:

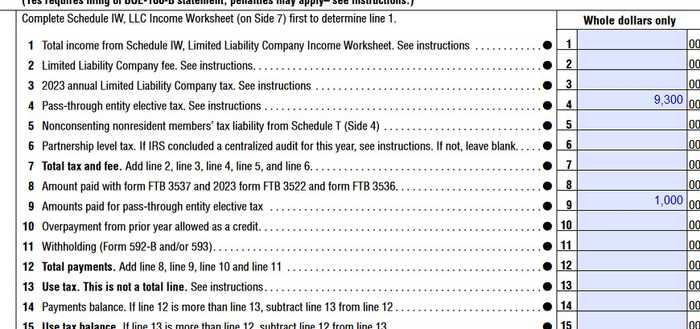

The number on line 3 of form 3804 flows to form 568, line 4. In addition, form 568, line 9 should show the total amount of the elective tax that was paid in the current year. See the screenshot below:

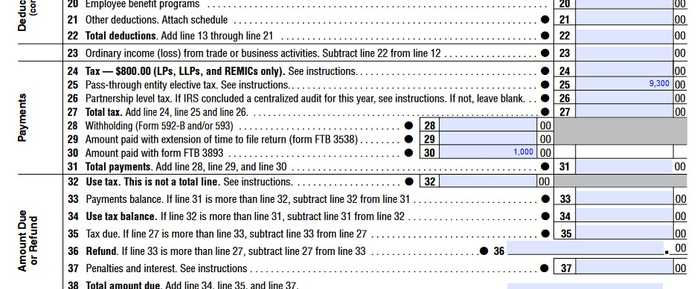

Partnerships: Similar to LLCs, Form 3804 should show the full amount of CA PTET tax that is allowed. The number on line 3 of this form will flow to form 565, line 25. The total amount of the elective tax that was previously paid is reported on Form 565, line 30. See below:

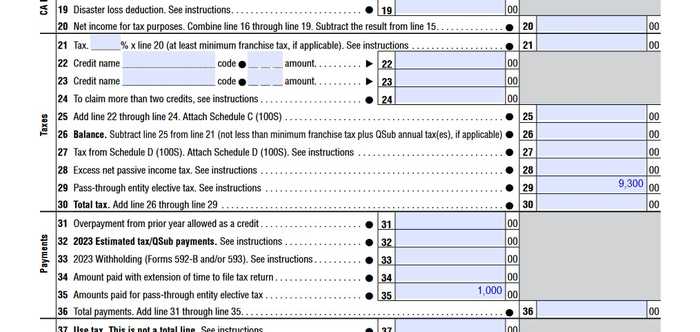

S corporations: Similar to LLCs and partnerships, Form 3804 should show the full amount of the CA PTET tax. The number on line 3 of this form will flow to form 100S, line 29. The total amount of the elective tax that was previously paid is reported on Form 100S, line 35. See below:

How to Report a CA PTET Payment on California Personal Return?

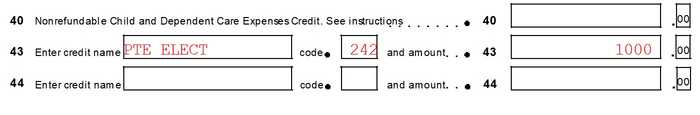

The CA PTET payment goes on line 43 of a California personal return. See below:

To summarize, the CA PTET helps business owners save on personal federal taxes by deducting a portion of their California estimated tax payments on their business return. This deduction lowers the entity’s federal taxable income, which then flows to the owner’s K-1, resulting in lower personal federal taxes. The entity needs to make two payments and deduct the tax in the year it's paid. To elect into the CA PTET option, the first payment must be made before June 15th of the current year, and Form 3804 must be included with the California business return.

A little Self - Promotion: If you ever need help with your business tax returns or accounting, please contact us. We have helped hundreds of California business owners with their tax planning and tax saving strategies. You can read more about our services here.