Your S Corp finally started to bring profits and money is sitting in your business account, and you itch to take it out. But how?

As you probably heard, the IRS considers an S Corp owner both an employee and an investor. Hence, you move money out of the S Corp in two ways: by paying yourself a salary as an employee and by simply taking money out of the company as an investor.

S Corp Salary vs. S Corp Distributions

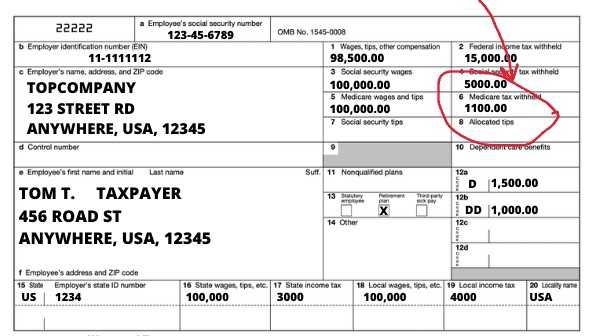

A salary is your employee side of the pay and it is reported on your W-2. When you pay yourself a salary through a payroll software, you move money from your business account to your personal account. As a part of the payroll process, you also pay self employment taxes on this salary. If you look at the W-2 bellow, you will see self employment taxes in boxes 4 and 5.

These taxes are simply taken out of your paycheck ( in most cases without you realizing it). But this is only one part of your self employment tax expense. The second part of the self-employment tax is paid from your S Corp account and this happens behind the payroll scenes.

Yes, this hurts. Self-employment taxes are a pain for all self-employed people since it feels like robbery to pay additional 15% in taxes on top of regular taxes. And this is where the concept of S Corp reasonable compensation comes in. Reasonable compensation (or in other words shareholder salary, wages, or the shareholder W-2) is based on what you would pay someone else to run your business. And because self employment tax is paid only your wages, here’s a race to bring down yoir W-2 — of course, legally. We’ve written about reasonable compensation in detail here.

As we've said earlier, by issuing yourself a W-2, you transfer money from your business account to your personal account. But since we aim for the W-2 to be less than our total income, what do we do with the rest of the money sitting in your business bank account?

Well, we simply transfer the remaining money via a bank transfer, Zelle, PayPal, or simply withdrawing this cash out the business account. CPAs and the IRS call this type of withdrawals “shareholder distribution,” and this is where the investor part we mentioned earlier comes in. Distributions are not expenses; they are withdrawals or you can comsider them return of capital. You are taking money that you invested earlier into the business, which grew and started earning profits. Distributions do not decrease your net profits. They show up in a special place on your S Corp K-1 (you will see it below) and this allows the IRS compare shareholder wages and shareholder distributions.

How Are S Corps Taxed?

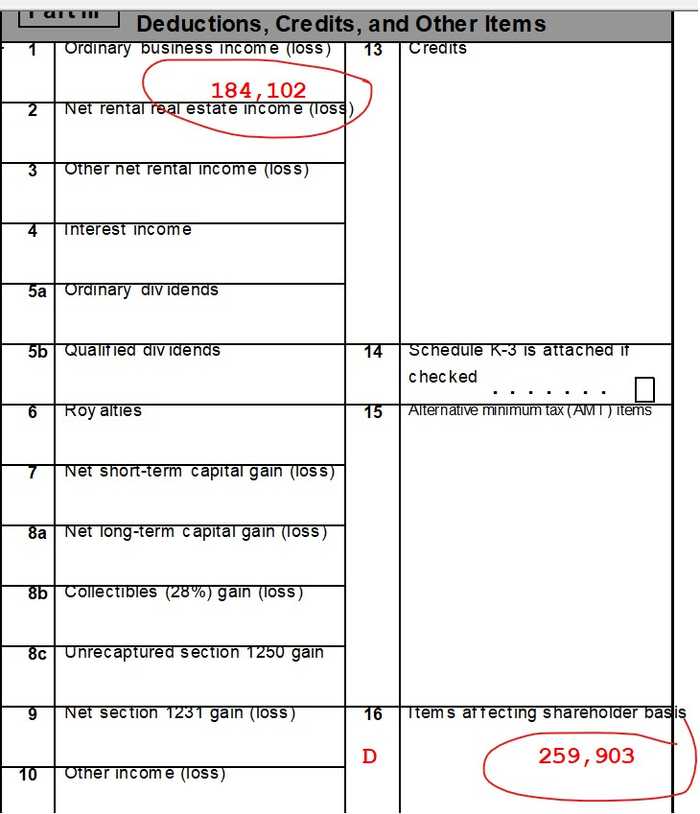

S Corps themselves are pass-through entities and do not get taxed. Instead, they shift their income to their owners, who then pay taxes on business income according to their personal tax rate and depending on other income the owners bring in. How does the business income shift from the S Corp to the owners? One part is the W-2 issued under the owner's Social Security number. The other part is the K-1 form, also issued under the owner’s SSN, which flows to their personal return. We looked at the W-2 earlier. Now lets zoom onto a K-1 form. What does the K-1 reflect? Two main things:

-

Shareholder net income from the S Corp (this excludes shareholder wages, as these were a deduction on the S Corp return and have already been passed to the shareholder's individual level). You can see that net income on K-1 below in box 1.

-

Shareholder distribution in box 16. This box tells the IRS how much was taken out of the S Corp’s bank account. You can see distributions in box 16D on K-1 below.

Please note: You pay taxes on the amount reflected in box 1 of your K-1 and also on your W-2. You pay self employment taxes only on W-2s. Your K-1 income in box 1 is not subject to self employment tax. It is subject only to regular taxes. Typically, you are not taxed on your distributions in box 16D, since they are simply withdrawals from your bank account and the income has already been taxed in box 1 of your K-1.

Are S Corp Distributions Taxed at all?

I have just used the word “typically” in the previous sentence. Yes, usually shareholder distributions are tax-free unless a certain situation arises. It all comes down to the concept of S Corp basis, which is a notion created by the IRS to figure out if distributions are taxable.

In simple terms, basis is how much you put into the company, plus or minus your S Corp profits, minus how much you took out. Here is a detailed blog on it. If you take money out of the company while maintaining your basis above zero, your distributions are tax-free. This is the most normal and natural way things play out when business owners take money out of S Corps. Why not? You’ve already paid taxes on the whole amount shown in box 1 (remember the picture earlier?).

However, in some cases, distributions can be double-taxed as capital gains. This happens when the shareholder's basis is depleted. How can this occur? Well, in our experience, it usually results from accounting errors, loans from third parties, or, for accrual payers, prepayments for services not yet earned. We wrote a more in-depth article on this subject here, which you are welcome to review. In short, if your distribution depletes the basis on the work paper, you will automatically owe capital gains tax on this withdrawal on both the federal and, most likely, state level.

How do we know the basis? Well, usually CPAs track it for you without letting you know on your individual tax return. You will most likely see in on your 1040 if you look for form 7203 and a work paper named "the adjusted basis"

No Salary or Distributions in an S Corp

As I mentioned earlier, if you take distributions out of your S Corp account, you should also pay the IRS some self-employment taxes by issuing a W-2.

However, what happens if you keep all the money inside the S Corp and don’t take any cash out? This is an interesting topic. On the one hand, you didn’t use the money personally, so there’s no reason to issue yourself a W-2 and pay self-employment tax on it. But the next question is: Why aren’t you taking money out of the S Corp in the first place? If you’re holding onto the money because you plan to spend it on business expenses next year, then it's a justifiable reason not to issue a W-2 or take distributions. But what if you're sitting on the money just to take it out in the next calendar year? This would mean you didn’t pay self-employment tax on withdrawals (because there was no a W-2 Issued) in the previous year and are now getting the money free of self-employment tax. This practice is wrong as it shows a clear intention to avoid paying self-employment tax. It’s always advisable to distribute the money in the year earned (and also pay yourself a W-2) to cover your back in case of an IRS audit.

You can put this extra cash into a savings account and contribute it back to the S Corp when needed. S Corps with multiple shareholders should always follow the pro-rata schedule and distribute profits evenly between all shareholders. Otherwise, the S Corp could lose its status due to preferential treatment for different owners.

Should You Draw a W-2 When There Is a Loss Year in the S Corp?

There is no requirement to issue a W-2 when the S Corp’s books show a loss. And think about it: If you are pumping your personal savings (on which you’ve already paid tax) into an S Corp that isn’t making a profit, there’s no reason to issue yourself a W-2 and pay tax on the same money again.

Salary vs. Distributions: What Comes First?

The rule of thumb is that wages must come first before distributions. This is because the IRS knows that business owners try to save on self-employment taxes and tend to avoid issuing themselves W-2s. Whatever is left after wages can be taken out using any of the methods we’ve described. Does the IRS really know which came first? No. Based on the tax paperwork the see, the IRS can only see the total distributions on the K-1 and the shareholder salary. Knowing that fact, in some cases, CPAs “patch up” accounting and reclassify some part of distributions to wages (and issue W-2 payroll paperwork) later because this strategy is better than not paying self-employment tax at all. But if you're managing your S Corp yourself, you may be confused by accounting journal entries, and it’s better to follow the rules: wages first and distributions (whatever is left) second.

S Corp Shareholder 60/40 Distribution Rule

Since we’ve figured out how distributions work and know that the lower the W-2, the less self-employment tax you pay, you might be wondering how much in W-2 wages you can get away with. What would be an appropriate amount to keep the IRS happy? This is where you start hearing rules like 60/40 or 70/30. 60 or 70 percent is allocated to distributions, and 30 or 40 percent is allocated to the shareholder W-2. Conveniently, a smaller percentage is always allocated to salary. I’m not sure where these percentages originated, but I assume some CPAs suggest them based on what they see on tax returns, believing that these percentages are "IRS safe". There’s also a correlation between a higher QBI deduction and the salary number. We wrote more on the QBI topic here. But in reality, there is no IRS rule that dictates these percentages. As we mentioned earlier, your salary should depend on what you would pay someone else to do the same job. If you wear multiple hats in your business (e.g., administrative assistant, professional, marketing manager, and/or janitor), you can break down your salary into different positions and allocate wages based on the hours spent in each role. This would be the most thorough way of figuring out your salary compensation, and tools like RCR reports can help calculate and document the final numbers. We’re not affiliated with this software, but it’s popular among CPAs and claims to be an audit-proof solution for the reasonable compensation issue in S Corps.

Of course, there are other strategies to arrive at a reasonable salary number, and the internet is full of ideas.

But the bottom line is that your W-2 number must be reasonable. Then the remaining profit will shown on your K-1 in box one and you will take the cash as a distribution without an issue.

What expenses can I pay out of my S Corp account?

Well, one of the rules you need to know is that you should never pay your personal expenses with business cards. First of all, this tactic messes with your accounting. Your business financials snow shows personal expenses, which corrupts your profits. Second of all, it also ruins your corporate veil, which is granted to you by your S Corporation status. And third of all, they would reclassed by your CPA to distributions anyway, so why bother?

The same rule applies to paying personal taxes out of your S Corp business tax account. Even though the S Corp triggered the tax liability, the taxes should be paid out of your personal bank account. This is because an S Corp is a pass-through entity, and all income and expenses get passed to the shareholder, who pays tax on the income on their individual 1040. So, the same rule as with personal expenses applies: if personal taxes were paid out of the S Corp account, they should be reclassified from expenses to distributions on your books. Otherwise, they distort your profitability, and you end up showing that you made very little income, as these personal payments are initially classified as expenses.

The only taxes that get paid and deducted from your S Corp accounts are business taxes. In California, this would be the franchise fee and, in some cases, the California PTET tax, which we described earlier here.

And now, a shameless plug: if you ever need help with your S Corp accounting and taxes, please keep us in mind. We’ve helped many California business owners with their tax planning, tax compliance, and accounting problems. Please check out our services here