S-Corp Late Filing Penalty Abatement: What You Need to Know.

Did you file your S-Corp late and receive an IRS notice with a penalty? Are you stressed out? Don’t be. There is a way to eliminate this penalty through the "penalty abatement” process. In this blog, we'll explore what S-Corp late filing penalty abatement is, when you qualify, and how to request it.

What Is an S-Corp Late Filing Penalty Anyway?

An S-Corp must file Form 1120S by the due date (typically March 15th for calendar-year filers). If filed late, the IRS imposes penalties, which are automatically generated by their system. If you forgot to put your S Corp on extension by March 15th and filed a month later—let's say in April—this is also considered a late filing and your S corp will be penalized.

Note: You’ll be penalized for filing late, even if your S-Corp had no income. The penalty is based on lateness, not income.

The penalty is generally $210 per month ( as of now), multiplied by the number of shareholders.

Example:

If 3 months late with 4 shareholders, the penalty is:

4 shareholders x $210 x 3 months = $2,520

What Is Penalty Abatement?

Penalty abatement is a process through which taxpayers, including S-Corps, can request relief from IRS-imposed penalties. Essentially, you can ask the IRS to remove the penalties if you have a valid reason.

You can try to abate this penalty by using one of the following reasons:

- Reasonable Cause:

If you can demonstrate reasonable cause for late filing, such as serious illness, natural disasters, or other uncontrollable events, the IRS may grant penalty abatement.

Example: If a key person in the company fell ill or passed away during tax season, you might qualify for relief. - First-Time Penalty Abatement (FTA):

If your S-Corp has a clean filing history, the IRS will abate penalties without requiring a reasonable cause.

Please note: Do not confuse or mingle these two abatement processes. They are separate types of abatements. For First-Time Penalty Abatement (FTA), you don’t need to provide a reasonable cause! Yes, that’s correct—there’s no need to come up with an excuse or create a sad story. All you need to do is comply with the IRS requirements for first-time penalty abatement, and you are guaranteed to get it. So, what are the requirements for the First Time Penalty Abatement?

Requirements for First-Time Penalty Abatement (FTA)

- No Prior Penalties in the Last Three Years.

To qualify for FTA, your S-Corp should not have any penalties for late filing or payment in the past three years. If your S-Corp has been penalized during previous three years, you're not eligible for FTA. Please note: your personal tax return is a separate issue and does not affect the S-Corp situation. Also, if this is your first year of operating as an S-Corp, you automatically meet the FTA requirement. - Timely Filing of All Required Returns.

Previous S-Corp Form 1120S must be filed on time before requesting FTA. If you have unfiled returns, you must submit them first. Otherwise, your FTA request will be rejected.

So, How to Get Out of the Late Filing Penalty?

First of all, try first time penalty abatement route before pursuing the more labor- and emotionally-intensive reasonable cause option. First time penalty abatement is always the first step, and it is almost a guaranteed abatement as long as you meet the requirements above. Please note: you can receive FTA every three years. For example, if your S-Corp was late filing for 2016, 2019, 2020, and 2021, you could request penalty abatement for 2016 and 2020.

Step-by-Step Directions:

- Do not pay the penalty, even if the internet tells you to! In our experience, the IRS is very lenient with FTA abatements, and they tend to abate it even without you paying it.

- Call the IRS and ask for the first-time abatement. Again, there’s no need to come up with a sob story when asking for FTA. You also don’t need to write a letter or send a fax—just call. The IRS agent will look up your S Corps tax compliance history while on the phone and will most likely give you an answer right there: whether you qualify for FTA or not, and if not, the reason why. If the cause is unfiled returns, you can file them and ask for FTA again. In most cases, FTA gets disqualified due to prior penalties within the past three years, but all other requirements can be fixed.

- What if the IRS agent says no? Hang up and call again to speak to someone else. Make sure you call the phone number on the notice and not the general IRS number. This way, you will talk to the department dealing with your specific situation.

- An additional tip: The IRS has unknown thresholds of penalties that can be waived over the phone. If the penalties are too high, they may ask you to file Form 843 and explain the situation. In this case, Form 843 is your next step. But again, call twice to verify this requirement. IRS agents are human, and some of them may be new or not properly trained.

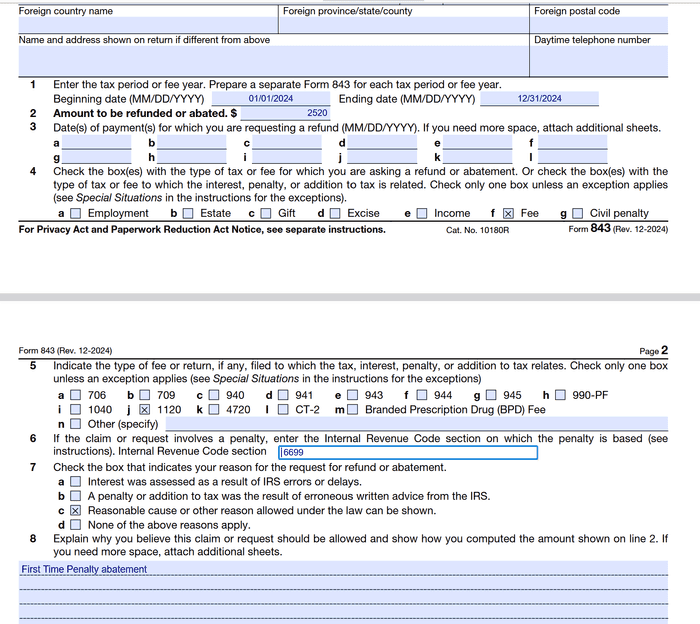

Again, you don’t really need to give an explanation of why you are asking for FTA, as long as you meet the criteria I mentioned above. And this is how you fill out Form 843 for first time abatement cause:

Here is a link to the IRS page explaining first time abatement rules in case you want to double check the facts in this blog.

What About States?

Don’t forget about states! Some states also impose penalties for late filing and have their own rules on penalty abatements. You would need to research the state's tax website to see if they allow abatement. Or, just like with the IRS, sometimes it’s easier to call and ask an agent who may guide you in the right direction.

Final Thoughts:

If your S-Corp is facing late filing penalties, you don’t have to pay them right away. Try to abate them first via First-Time Penalty Abatement by calling the IRS. If that doesn’t work, try filing Form 843. But remember: If your S-Corp had problems in the past, you won’t get the abatement, no matter how much you try. If that’s the case, you can move to the reasonable cause route and submit a sad letter, attaching it to Form 843. But always start with FTA, as with a good filing history, it is almost guaranteed!

And now a shameless plug: Our CPA firm provides tax planning, tax preparation and accounting services to S Corp owners. You are welcome to check out our services here.