Many tax software programs automatically calculate the gain or loss from selling a business vehicle, but they don't always get it right. Before you hit the "submit" button, take a moment to understand the calculation. You're the one signing the tax return and responsible for its accuracy, so it's important to double-check the software numbers. Here's a simple step-by-step guide to help you calculate the gain or loss.

Understanding the Gain / Loss Formula

The formula for calculating gain on the sale of any business asset, including a vehicle, is relatively straightforward:

Selling Price – Original Cost + Depreciation = Taxable Gain or Loss

Let’s break it down:

- Selling Price: This is the amount you received from the sale. Example: You sold your car for $30,000.

- Original Cost: This is the price you originally paid for the vehicle and entered in your tax software when you first got it. For example, you bought your car for $40,000.

- Depreciation: Depreciation is a method of deducting a part of the vehicle's cost in a particular tax year. For the purpose of this calculation, we need to know the sum of all depreciation expenses you took on previous tax returns for your car. Accountants also have a special name for the sum of previous depreciation expenses - "accumulated depreciation". For now, let’s assume that over the years you claimed $20,000 worth of accumulated depreciation. We will talk about how we arrived at this number later.

And here is the kicker: If you look at the formula again, you will see that depreciation is essentially a "timing difference". Depreciation allows you to deduct a part of the cost of the vehicle in one year, reducing your taxable income for that year. However, when you sell your vehicle, the depreciation you’ve claimed over time gets added back and increases your taxable gain.

Whether the vehicle was used partially or fully for business, it doesn’t matter. What we are looking for is the total amount of accumulated depreciation since we have to add it back.

Reporting the Sale of the Vehicle on Your Tax Return

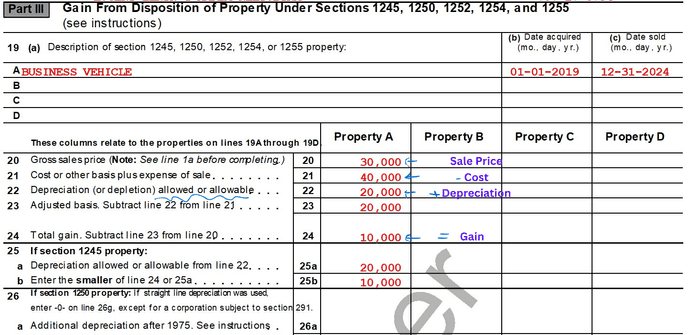

Once you’ve collected your numbers, it’s time to enter them on your tax return. The IRS has a special form for this calculation: Form 4797. This is the form where you calculate the gain or loss on the sale of business assets.

Let’s use the numbers from above and plug them into the formula and then into the IRS form:

- Selling price: $30,000

- Original cost: $40,000

- Depreciation: $20,000

$30,000-$40,000+$20,000=$10,000 of gain

Now let see how this calculation is presented on the form 4797:

According to our calculations, the gain on this sale is $10,000. Wow! How come, you will ask. I sold the car for less than I bought. I should have a loss! But unfortunately we have to add back depreciation expenses that were taken in previous years. And by the way, did you notice that the 4797 form says allowed or allowable when it comes to depreciation? Yes, the rule here is that if depreciation was allowed but not taken on a previous tax return, you still have to add it back when calculating the gain. Most of us, however, will not miss a depreciation expense.

Reconstructing Accumulated Depreciation: Known Challenge

Now, once you understand the formula, let’s focus on technicalities, in particular, on how to gather information on all depreciation expenses that have been claimed in previous tax years. As you probably know, there are two primary methods for calculating depreciation:

- Actual Cost Method: This method involves tracking all the expenses related to the vehicle, including depreciation. With the actual method, you can also elect to take Section 179 or bonus depreciation, which in essence is a type of the depreciation expense.

- Standard Mileage Rate: This method allows you to claim a fixed amount for every business mile you drove. The IRS sets a standard mileage rate each year, which includes an element for depreciation, among other expenses.

If you are rusty on the difference between actual and standard mileage methods, you are welcome to brush up on this subject here. The task of this blog is to teach you how to collect all information on previous depreciation taken for the sold vehicle.

How to Track Depreciation Claimed via the Actual Method

Tax software in general does a good job tracking depreciation expenses that were taken via the actual method as long as you consistently used the same tax software. Your software should have a "depreciation detail" worksheet that shows all accumulated depreciation for all years.

If you can’t find that worksheet, you would need to review your previous tax returns and find out how much depreciation expense was taken in each year. Look for the depreciation expense claimed each year and add it up to get the total accumulated depreciation number.

How to Track Depreciation Claimed with the Standard Mileage Rate

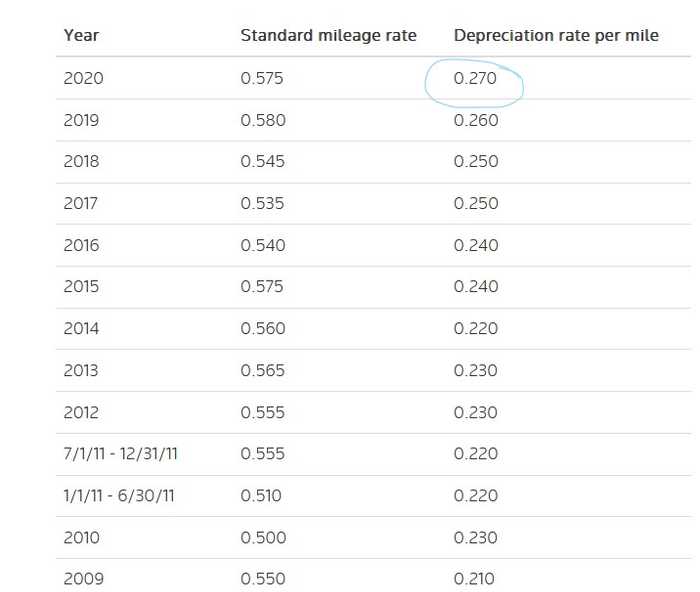

If you used the standard mileage rate, depreciation is baked into that mileage rate. Every year, the IRS gives a different depreciation rate per business mile driven. Here is a summary that shows depreciation per mile in most recent years.

To calculate the depreciation portion, look at the number of miles you drove for business each year. Tax returns have an “auto worksheet” that shows this information. Multiply the number of business miles by the depreciation component of the mileage rate.

For example, lets look at the image above. If you claimed 10,000 business miles on your 2020 tax return, and the IRS allows 27 cents per mile for depreciation for that tax year, you would get $2,700 of depreciation expense for that year (10,000 * 0.27).

Repeat this process for each year you used the standard mileage rate. Yes, this means you would need to dig out your old tax returns to find this information. In my experience, tax software does not typically track information on the depreciation component via the standard method, and it is entirely up to you to figure out the previous depreciation number.

Please note: if you alternated between actual and standard methods throughout the years, you would still need to come up with the sum of all depreciation expenses. This means you would need to calculate depreciation expenses separately for each year and then add them up.

Depreciation Recapture: A Nasty Surprise

If you sold your vehicle at a gain, the IRS requires you to “recapture” the depreciation you’ve previously claimed. This means that the portion of the gain attributable to the accumulated depreciation that you calculated will be taxed as ordinary income. This could result in a higher tax rate for that portion of the gain. The rest of the gain (if there is any) will be taxed as a capital gain, and capital gains usually get better tax rates.

Losses: If you sell the vehicle at a loss using the formula that we have just learned, you can treat the loss as ordinary, which allows the loss to offset your other ordinary income and reduce your tax liability.

Example: Let’s use the original example: You sold your vehicle with an original cost of $40,000 and accumulated depreciation of $20,000 for $30,000. As we discussed earlier, the total gain on sale would be $10,000. The total gain will be taxed at ordinary income tax rates since accumulated depreciation was $20,000.

If you had sold the vehicle for $5,000, the total loss would be an ordinary loss and would offset your other business income, bringing down your tax liability.

Tax Pro Tip: even if the business vehicle was taken out of business and was used personally and only after that sold, the sale of the vehicle still needs to be reported, and accumulated depreciation needs to be calculated (which can result in taxable gain).

Final Thoughts

Calculating gain on the sale of a business vehicle isn’t as straightforward as just handing over the keys. You’ve got to track depreciation, use the formula, and understand different tax rates. But by following the steps above, you can confidently calculate your gain or loss and make sure your tax return is in good shape.

If you’re feeling overwhelmed by the tax paperwork or need help figuring out the numbers, don’t hesitate to reach out. We’ve helped hundreds of California business owners navigate these tax twists and turns. You are welcome to check out our services here.