So… you got paid in cash. Now what? Well, first of all, spend it wisely. Second, make sure you comply with the IRS cash reporting requirements.

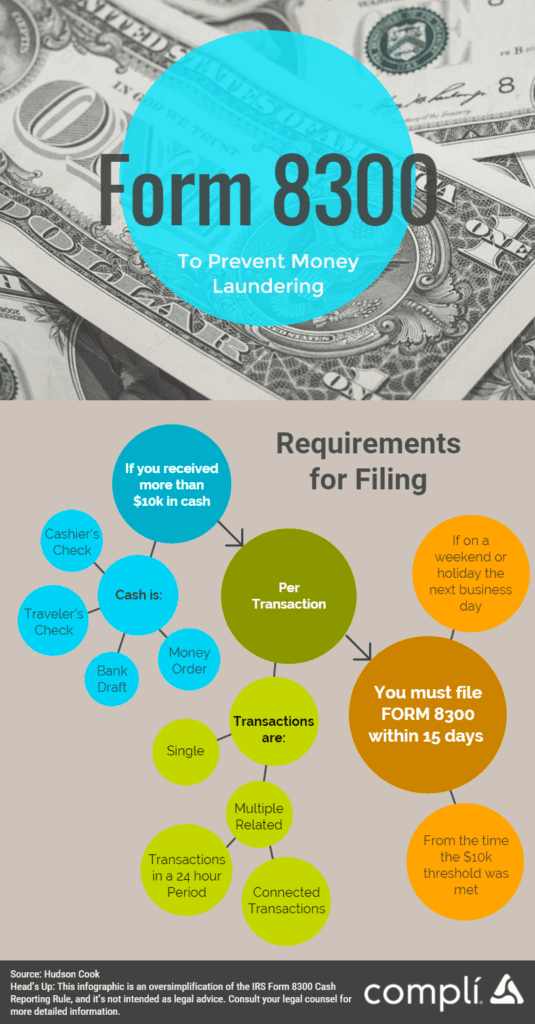

The IRS combats money laundering and wants to track any large movements of cash. A person who receives a large amount of money may be required to file Form 8300.

Question: What is the IRS Form 8300 requirement?

Answer: You must file Form 8300 whenever you receive $10,000 as a lump sum or when you accept smaller amounts that total $10,000 and are received within 24 hours. You should also file the form if you receive cash within 12 months, and each payment is part of the same deal. Additionally, only business transactions need to be reported; one-time personal payments do not have a reporting requirement.

Question: What do I consider cash for the IRS Form 8300?

Answer: Money, cashier’s checks, money orders, and bank drafts are considered cash. A personal check drawn on the buyer’s bank account is not considered cash, and you do not have to report it.

Question: What's the deadline for IRS Form 8300?

Answer: You are required to file the form within 15 days of the transaction. If you forget to submit the form, you will incur a penalty of $310, not to exceed $7,873,000 per calendar year (as of 2024). Penalties for intentional late filing are much higher and can include criminal sanction.

Here are some tips that will help you to file your first Fincen form 8300:

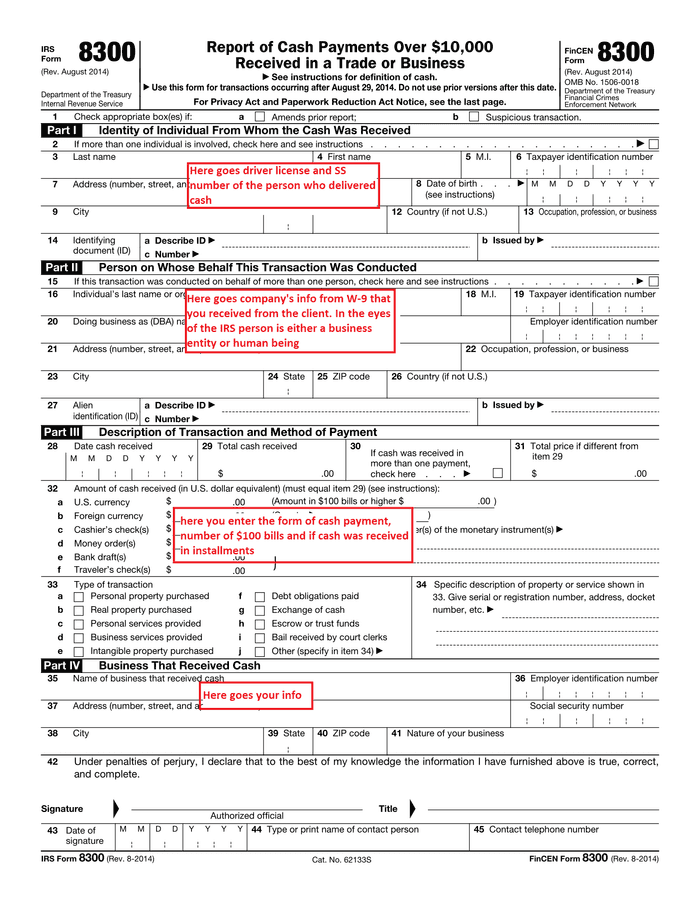

Collect buyers information: Before the meeting, inform your client that you will need the following documents:

- ID (driver license will do) and SS number of the person delivering the cash. It is enough to take a picture of both documents.

- Form W-9. This paper does not get filed with the IRS. The buyer fills out and signs this form for your records.

- Make sure to record how many $100 bills were in the payment. This information goes in Part III of the form.

Useful Tip: It is crucial to collect this information before or during a sale. In our experience, there is very little chance that the buyer will be willing to provide the information after your meeting is over. The responsibility for filing is on you, not the buyer, and the buyer has no incentive to provide their personal information on a later date.

What to do if the client is not responding? If you cannot get all of the necessary information from your cannabis buyer, try to do your best. Contact the client in a written form and ask again. If the client refuses to communicate or ignores your attempts, keep a copy of all of your communication. This will be proof of your compliance. Complete the IRS form 8300 with the information you have on file, and attach a statement explaining your attempts to collect the missing data.

How to fill out the IRS form 8300? Please see the visual aid below. The form itself is pretty easy:

How to file the IRS form 8300: You can either e-file this form or send it via mail. If mailing to the IRS, remember that the day of filing is the day you mailed the envelope. So, if you post the form precisely 15 days after the transaction, you will be in good shape as long as you keep proof of mailing.

Please note: Starting January 1, 2024, businesses that e-file certain forms, like Forms 1099 and W-2, must also e-file Form 8300 if they file at least 10 information returns of any type (other than Form 8300) in a calendar year. The number of Form 8300 filed does not count toward the 10-return requirement.

For example, if a business submits five Forms W-2 and five Forms 1099-INT in 2024, they must e-file all information returns, including any Forms 8300. However, if they file fewer than 10 forms of any type (excluding Forms 8300), they do not have to e-file any forms, including Form 8300. Even if not required, a business can still choose to e-file if they wish.

Statement to the buyer: By January 31st, you will have to furnish your cash client with a statement that informs them of your 8300 form filings activity. The report is in free form but should include the following information: contact information of both parties, the total amount of reportable cash in the past year, and notification that the company provided the information mentioned above to the IRS. The IRS imposes enormous penalties for failure to provide statements to buyers. So, make sure that you send them out by the end of January.

And now a shameless plug: We are an accounting firm helping business owners with their taxation and accounting issues. Please keep us in mind if you ever need help. You can read about our services here: