You made a good chunk of money this year! But TurboTax has some bad news for you: you owe more than you can afford!

So, you search: “Why do I owe so much as self-employed?” and a kind soul on a random forum gives you the answer: self-employment tax. More research reveals that an S Corporation could reduce these taxes. But then you discover that there were deadlines (of course, you missed them because no one told you) to lock into the S Corp status. Fortunately, there’s a secret solution everyone on the internet is talking about, and it’s called a late S Corp election. And here you are, reading this blog, looking for step-by-step instructions on filling out that mysterious form 2553! You want to cut your tax bill now!

Yes, my dear reader, I will give you exactly that, because I’m a kind soul too—and because my website needs traffic.

Let's start by opening this IRS PDF form. This way you can fill out the form online and print it out once you’re done.

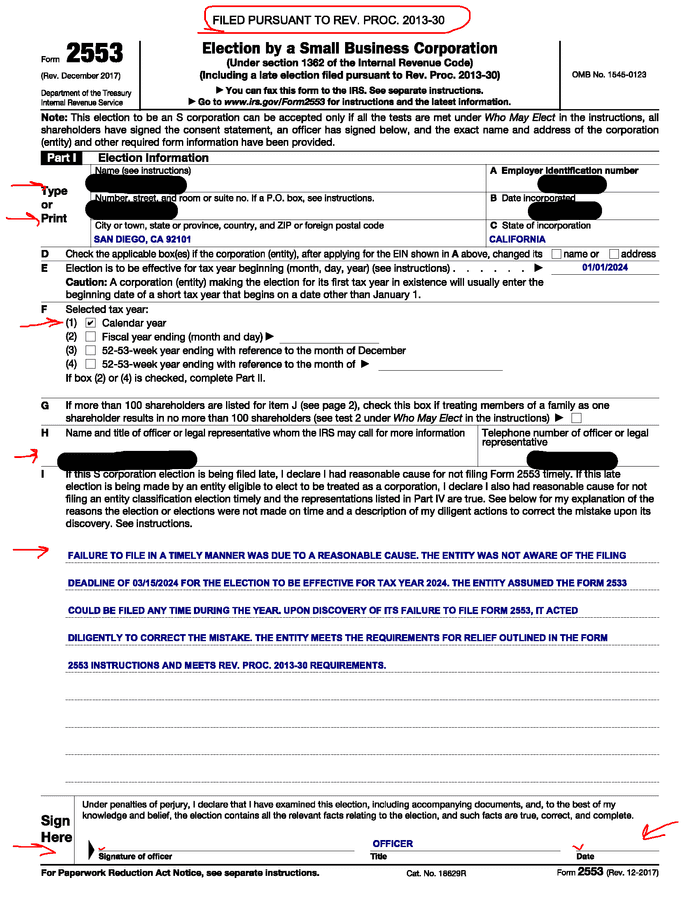

I am attaching a mock form below as an example. Let’s go through the first page first:

Part 1:

- Name of Corporation and Employer Identification Number (EIN): Those are self explanatory. Enter the full name of the corporation exactly as it appears on your corporate documents and provide its EIN. If you don’t have an EIN, you’ll need to apply for one before filling out this form.

- Address and Date Incorporated: Enter your corporation’s principal business address, including street, city, state, and ZIP code. Then, provide the incorporation date from your state documents—the date you started your LLC or Corporation in your state.

- State of Incorporation: Indicate the state where your LLC was incorporated.

Line E: Election is to be effective for the tax year beginning (month, day, year). When filing a late S Corp election, use 01/01 as the start date for your S Corp.

Line F: Choose a tax year. The simplest option is to select a calendar year, which most taxpayers use. However, if you have a different tax year preference (I strongly suggest to discuss this with your accountant first), indicate it here.

Line H: Name, title of the officer, and their contact information. Put your information in case the IRS needs to contact you.

Line I: Explain the reason for being late. Oh. This is the emotionally difficult part. To understand what to write, you need to understand what Rev. Proc. 2013-30 is all about. You can read the official document here. In short, this document says that the IRS will grant a late S Corp election as long as the business intended to be an S Corp and the only thing that prevented this was a late filing. The business must show reasonable cause for the delay and demonstrate that it acted promptly upon discovering the mistake.

Here’s an example for the wording for the 2024 tax year, assuming a business owner realized at the end of 2024 that they meant to have an S Corp status starting January 1, 2024. This wording typically (but no guarantees from our accounting firm) leads to an approved election:

"FAILURE TO FILE IN A TIMELY MANNER WAS DUE TO A REASONABLE CAUSE. THE ENTITY WAS NOT AWARE OF THE FILING DEADLINE OF 03/15/2024 FOR THE ELECTION TO BE EFFECTIVE FOR TAX YEAR 2024. THE ENTITY ASSUMED FORM 2553 COULD BE FILED ANY TIME DURING THE YEAR. UPON DISCOVERY OF ITS FAILURE TO FILE FORM 2553, IT ACTED DILIGENTLY TO CORRECT THE MISTAKE. THE ENTITY MEETS THE REQUIREMENTS FOR RELIEF OUTLINED IN THE FORM 2553 INSTRUCTIONS AND MEETS REV. PROC. 2013-30 REQUIREMENTS."

Don’t forget to sign and date the first page of Form 2553.

On more detail: on the top of the first page, write in red, “FILED PURSUANT TO REV. PROC. 2013-30”.

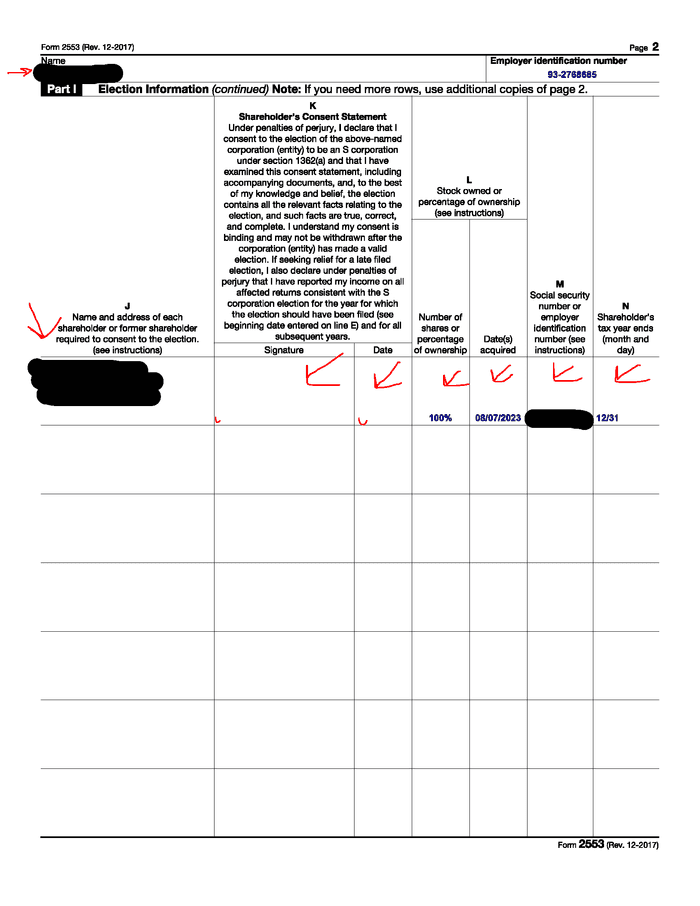

Now let's go through the second page of the form. See attached image below.

On the second page you’ll need to enter the shareholder(s) name, SSN, address, number of shares, and tax year-end. Each shareholder must sign and approve the form. In community property states, like California, spouses should also be listed even if they aren’t technically shareholders.

And there are pages three and four of this form. They are not presented here. Page three needs to be filled out ONLY when your tax year is not the calendar year (and you must have had a conversation about it with your accountant earlier). Page four needs to be filled out for S trusts election, so that one can be left blank as well.

Now it’s time to send the form. The form instructions allow you to either fax or mail it, but we recommend mailing it via certified mail to keep a record. After filing Form 2553, you should receive an acknowledgment letter(CP261 Notice) from the IRS confirming that your S Corp election was accepted. This letter typically arrives within 60 days of filing, but it can sometimes take up to six months—or, rarely, it might not arrive at all. That’s why you send it by certified mail and keep the tracking.

Hold onto that CP261 Notice for your records. The IRS occasionally misplaces paperwork, so good record-keeping is essential.

If your election gets rejected, you will receive a CP264 Notice, explaining the reason for the rejection.

TIP: Another way to file Form 2553 is by attaching it to the business’s first S corporation tax return (Form 1120-S) and mailing it. If you choose this approach, make sure to write “INCLUDES LATE ELECTION(S) FILED PURSUANT TO REV. PROC. 2013-30” on top of the first page of the S-Corp tax return. You could also try to e-file the S corp return if your tax software allows it. The only problem with this approach is that if your Form 2553 gets disapproved, you will face a rejected tax return, wasted time and additional penalties. All of this will take more time to sort out. That's why it makes more sense not to wait until the last moment to file Form 2553 along with the return. It is more practical to mail Form 2553 beforehand if time allows.

Finally, please note that a late S Corp election only works if you have an existing entity at the state level. You can’t request a late S Corp election if there was no LLC or corporation registered in your state on the date you want your S Corp to start. This is because S Corp status is given only to existing LLCs and corporations. We wrote about it in detail here.

And this is pretty much it! Go ahead! File away! And if you need help with accounting or S Corp tax matters, please reach out. We’ve helped hundreds of California business owners to save on taxes. You are welcome to check out our services here.