Owning a small business is exciting, but it also comes with added responsibilities—one of which is filing your business taxes. If you're just starting out and need guidance on how to handle your taxes, this blog is for you.

If you have a business partner, please check out my separate blog post , as having a partner typically requires a different type of a tax return and different tax preparation steps. This post is also not intended for businesses focused on renting properties or trading stocks, as these also require a different tax setup. Instead, this guide is for small business owners such as freelancers, independent contractors, and those with small service-based or product-based businesses.

If you're operating alone, your business is most likely structured as either a sole proprietorship (with or without an LLC) or an S Corporation. While S Corporations are more complex and often require professional help, many small business owners start as sole proprietors, which is the simplest structure to file taxes for—and one you can likely manage on your own.

Sole Proprietor Taxes: The Easiest Business Tax Form.

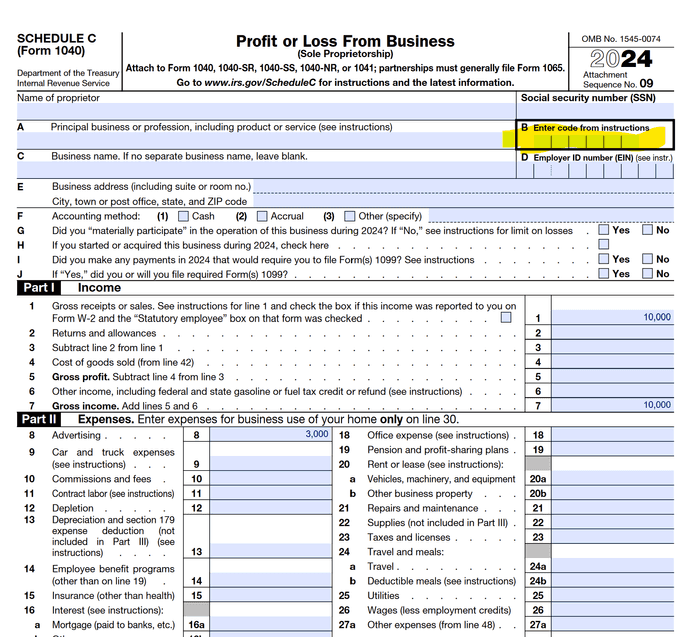

Sole proprietorship taxes are straightforward because they’re filed as a part of your personal tax return using IRS Schedule C. Unlike other business types, you don’t need an Employer Identification Number (EIN) unless specific conditions apply (such as hiring an employee or setting up a Solo 401k account). The IRS prefers that sole proprietors use their Social Security number to account for their small business taxes. The proprietor can also establish an LLC for its business, but for tax purposes, single member LLC and sole proprietors are taxed in the same way. If you are still confused about the difference between sole proprietorship and LLC, you can read our blog on this subject here.

Steps to File Your Sole Proprietorship Taxes:

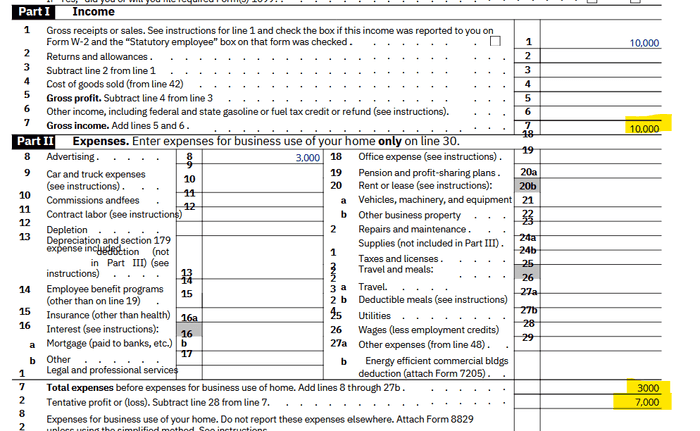

1. Get Familiar with Schedule C: Schedule C is where you report your business income and expenses. It’s structured simply: gross income at the top, followed by expenses that reduce income receipts. The difference between these two is your final net profit or loss. Below is a screenshot of Schedule C as an example, showing $10,000 in gross receipts minus $3,000 in advertising expenses, resulting in a net profit of $7,000.

Ultimately, you can access the actual form here. As I mentioned earlier, Schedule C is filed with your personal return, and the final net income numbers on Schedule C flow through to the rest of your personal return, affecting your overall tax liability.

2. Set Up an Excel Spreadsheet to Summarize your Finances: Create an Excel sheet (or use paper if you prefer) that mirrors the layout of Schedule C. This spreadsheet will be your Proft and Loss Statement - a financial statement used by all businesses. Welcome to the world of accounting! List your gross receipts on top and your business expenses below and the difference between thses two will be your business net profit. Here is a simple template of Profit and Loss Statement for your reference. Feel free to add or delete expense categories.

3. Calculate Gross Receipts: Add up all income you earned during the tax year, whether it’s cash, payments via Venmo, PayPal, Zelle, credit card transactions, or payments through online software. Everything goes in the same excel cell since the IRS cares about the total number of all your receipts from the business. If you had to refund the money, subtract those refunds and arrive to the new number beliw of adjusted gross receipts.

4. Identify Tax Deductions: Learn what qualifies as a deductible expense. Each business is unique and has its own set of particular expenses, but the general IRS rule is that business expenses must be ordinary and necessary to be deductible.

5. Review Your Financial Records: Go through your bank statements, invoices, and store receipts if you kept any. This helps to refresh your memory and find expenses that otherwise could be forgotten. Group similar expenses together in categories and enter categories of expenses into your spreadsheet / profit and loss statement.

6. Understand Special Deductions: If you work from home, learn about the home office deduction, and if you drive for business purposes, read up on business mileage deductions. Both expenses are calculated separately on special worksheets, and you will need to understand the theory behind them before calculating those expenses. Here are refresher blogs on business use of home and business mileage. Once you figure out the numbers for your business use of home and vehicle deduction, enter them into your excel spreadsheet.

7. Consider Health Insurance Deduction: If you had to buy your own health insurance from a market place or health insurance company directly, it might classify as a deduction. Here is a blog explaining in what cases insurance premiums can be deducted. However, please note that this deduction is not reported directly on Schedule C; it’s included elsewhere on your personal return and brings down your total taxable income.

8. Learn About the Cohan Rule: If you lack documentation for some expenses (we see this happen a lot during the initial year when clients are completely caught off guard with their first year taxes), read up on the Cohan rule. This rule allows for reasonable estimates of business expenses, except for entertainment, meal, and mileage expenses. It is okay to use this rule occasionally, but you need to keep better records in the future. Here is a good blog on this topic.

9. Handle Large Purchases with Depreciation: If you bought expensive assets for your business, you may need to depreciate them instead of putting them on Schedule C directly. With depreciation, you may also get to deduct the asset in full in the first year (thanks to Section 179 depreciation), but the input must be done through a different worksheet that flows into the Schedule C.

10. Calculate Your Net Income: Subtract your total expenses from your gross receipts to find your net income. The net income figure is crucial because it determines your self-employment tax, which is almost 15% of your net income. Obviously, the more deductions you find, the lower your net income will be, and the less self-employment tax you will pay.

11. Enter Your Data into Tax Software or Get Help from a CPA: Once you've organized your information on the excel spreadsheet, transfer it into Schedule C in your DIY tax software. If you find this step challenging, consider hiring a CPA. Keep in mind that even if you work with a CPA, you're still responsible for providing the details about your expenses, since no one can know this information besides you.

12. Find out your NAICS Number: If you file the return on your own, be sure to enter the correct NAICS code for your business in your tax software. The IRS uses this information to compare your return with industry averages. Using the wrong NAICS code could increase your risk of an audit, as it may cause your expense percentages to appear out of line with others in your industry. This is where this number would show up on Schedule C:

13. Check for Business Losses: If your net income is negative, you won’t owe self-employment tax, and your business loss can offset other income, reducing your overall tax bill. Even if you don’t have a profit, it is important to file your Schedule C since the loss will offset your other taxable income or be carried over to the next year.

14. Prepare to Pay Taxes on Business Profit: If you have a positive net profit, you’ll owe self-employment tax (about 15%) plus regular federal and state income taxes on that amount.

15. Consider Utilizing a SEP IRA in Profitable Years: If your net income is substantial, consider setting up a SEP IRA to reduce your tax burden. SEP IRA contributions are deductible, and the SEP IRA account can be set up next year after the April deadline, allowing you to contribute the exact amount as long as you are timely filing your taxes or put yourself on extension.

16. Check Your Tax Return for LLC Details or Contact Support: If you’ve registered your business as a Single-Member LLC, you still file taxes using Schedule C. The IRS treats single-member LLCs as “disregarded entities,” meaning the LLC’s income and expenses flow through your personal tax return on schedule C. You would still need to file an LLC return with your state. Since LLCs are governed by state rules, DIY software may not always support filing LLC forms in your particular state. So, we suggest going over your tax return looking for the LLC attached and if not, contacting customer support of your tax software. They may advise you to file the LLC forms separately on the state website.

17. Final Checks Before Submitting Your Taxes: Before submitting your tax return, compare the net profit or loss on your Excel spreadsheet with the figures on Schedule C. This is how most CPAs double-check their work. This strategy helps identify data entry errors and potential tax software mistakes (which do happen). Reviewing your calculations against the software also helps you understand the tax theory behind the form and improves your record-keeping skills.

18. Estimated Payments: Once you prepare your tax return, look for the vouchers for estimated tax payments. These will help you avoid an estimated tax penalty next year.

Final Thoughts

Filing taxes as a sole proprietor is simple, but still requires organization and an understanding of tax rules. By following these steps, you can confidently prepare your own taxes. However, if you’re ever in doubt, feel free to contact us for a consultation or tax preparation services. You can learn more about our offerings here.