The way you deduct medical premiums on an S Corp return is completely different from what you are used to doing on your personal return with the Schedule C. The same tax deduction on the S Corp tax return is more complicated as it includes adjustments to your W-2, Form 1040, and the S Corp's K-1. Of course, here we discuss deducting medical premiums for the S Corp owners (at least 2%) and not their employees.

So, what's the process?

1. Step One: Making Payroll Adjustments on Your W-2. When you are the main owner of your company and pay for your own medical and dental insurance with S Corp funds, the IRS requires that you include your premiums in your compensation (read: your W-2). What’s fun about that? This means that your reported income appears higher due to the inclusion of these premiums, which would typically mean paying more taxes, right? Not necessarily—just hear me out.

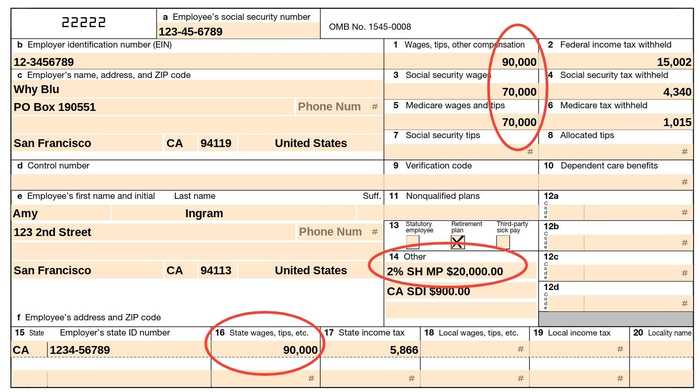

Health care premiums show up only in Box 1 of your W-2 (please see the example below). These premiums do not go in Boxes 3 (Social Security Wages) and 5 (Medicare Wages) of the W-2. For example, if your total compensation is $70,000 and you have $20,000 in health insurance premiums, your W-2 will show $90,000 in Box 1. However, Boxes 3 and 5 will only display $70,000. This means that Social Security and Medicare taxes are calculated based on $70,000 rather than on the inflated $90,000. Social Security and Medicare taxes (roughly 15%) won’t be imposed on these $20,000 of health care insurance premiums, which means you won't pay roughly $3,000 (20,000 * 0.15 = 3,000) on this amount.

The IRS also asks to show the amount of health insurance premiums in box 14 of the W-2. This is mostly done for informational purposes, so that anyone could figure out why there is a difference between boxes 1, 3, and 5.

Step two: Deducting Health Premiums on the S Corp Tax Return. On the S Corporation tax return (Form 1120S), you will deduct this medical expense automatically since health insurance is a part of the officer's wages (in other words, their W-2). This deduction will include the $90,000 from Box 1 of your W-2, as we discussed earlier (and not Boxes 3 and 5). The W-2 deduction will reduce the net income of your S Corporation.

However, on your personal return (Form 1040), the officer's W-2 will show $90,000 in taxable wages, which would include health insurance premiums. So, it will be a net: deduction on the S Corp return and inclusion of the same income on the personal return.

Note: You can also add a note (although not technically required) on the bottom of your K-1 form that shows the amount of health insurance deduction.

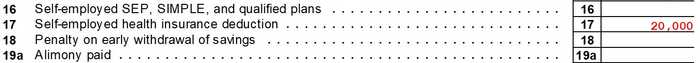

Step three: Deducting Health Insurance Premiums on Your Personal Tax Return (form 1040). To deduct S Corp health insurance premiums on your personal tax return, you will enter these premiums as a dollar-for-dollar reduction on Schedule 1, Line 17. This deduction will lower your adjusted gross income (AGI). See the example below:

So, the officer's W-2 will produce taxable income on their personal return. However, the same W-2 will be deducted as a business expense on the S Corp return, which brings us to the net. A separate deduction on line 17 of Schedule 1 will ultimately bring down our taxable income. Pretty complicated, if you ask me.

Are tax savings worth the accounting work? Most of the times, yes. But of course, it all depends on the amount of the health insurance expense and the net profit of the S Corporation. The additional benefit is that you get to deduct an expense without paying Medicare and Social Security wages on it. Also, the salary appears artificially higher because of the medical premiums, which is always helpful with reasonable compensation calculations.

And now a bit of self promotion: we've helped hundreds small business owners with their tax and accounting problems. If you ever need help, please reach out. You can also check out our services here.