If you own an S Corporation (S Corp) or a Limited Liability Company (LLC), you might have received a 1099-K. Let’s break down what the 1099-K form is, how it applies to your tax situation, and what to do if there’s an error.

What Is a 1099-K Form?

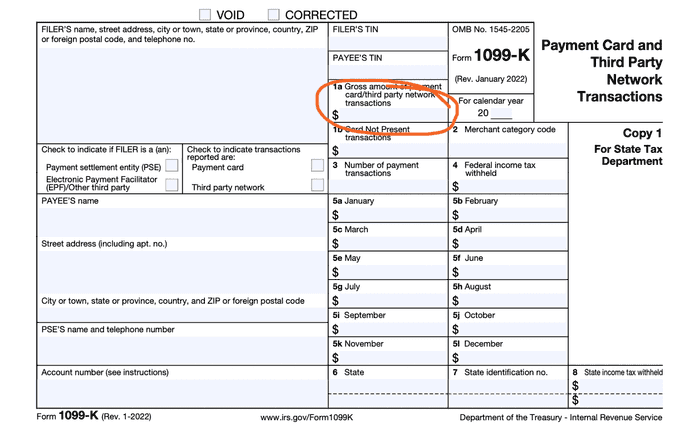

The 1099-K form is an informational form issued to report payments made through various payment processors like Stripe, Square, Etsy, PayPal, or even Quick Books. The form reflects gross payments received by your business during the year from a particular payment processor. There are specific thresholds for when a 1099-K must be issued: historically, the threshold was set at $20,000 in sales and more than 200 transactions, although the IRS has been pushing to lower these limits in recent years.

Why Does the IRS Care About 1099-K Forms?

The main reason is tax compliance. The IRS cross checks 1099 K forms with gross receipts claimed by tax payers on their tax returns. By matching 1099-K amounts with self-reported gross receipts, the IRS identifies businesses that under-report their earnings.

Please note that the 1099-K reflects the total sales amount processed, without reductions for refunds, merchant fees, or shipping costs. You still need to deduct these expenses separately on your tax return to determine your taxable income. Think of the 1099-K as a tip-off to the IRS that you received certain payments, but not a definitive amount of your taxable income.

For tax purposes, you only need to focus on the number reported in Box 1a. Please see where to look for this number below.

Differences Between LLC and S Corp:

The way the 1099-K is treated depends on the tax classification of your business. First, let’s clarify how the IRS treats LLCs and S Corps.

An LLC is a legal entity which is set up with your state. However, the IRS has its own tax rules and taxes LLCs differently depending on the number of partners and the owners' tax preferences. Here are the most common tax setups for LLCs:

- Single-Member LLC (Disregarded Entity): Reports income on the owner’s personal tax return (Form 1040, Schedule C).

- Multi-Member LLC: Treated as a partnership and reports income on Form 1065

- LLC Taxed as S Corp: Files Form 1120S.

Why is this differentiation important you ask? Because "LLC" is not really a tax term. If you want to figure out a tax issue, you need to focus on your tax entity type that I mentioned above.

Does the IRS Require 1099-K Forms for S Corps? Do LLCs Get 1099-K Forms?

Most of the S Corps should not receive 1099 forms due to the exemption under Section 1.6041-3(c) . However, many merchants issue 1099-K forms regardless of the entity tax type. Why? Because sometimes it is hard to determine whether the business files taxes as a sole proprietor with an LLC (when the 1099-K requirement applies) or as an S Corp that was initially set up as an LLC (where 1099-K is not required). If a business owner is confused about their own business tax structure or entered the wrong information into the software, the merchant has no way of getting this information right. So, the merchant issues forms to whoever qualifies under the gross receipts threshold just to comply with the IRS requirement. The IRS does not penalize merchants for issuing 1099-K forms to wrong tax entities, but they do fine merchants for not issuing forms to vendors that meet the gross receipts thresholds.

The main question isn’t whether you should have received a 1099-K, but how exactly you should report the 1099-K if you received it.

Please note: In our experience, the IRS typically does not cross-reference 1099-K forms with S Corp returns, but they do cross-reference 1099-Ks with numbers on Schedule Cs of sole proprietors/ single-member LLCs. But regardless of whether you’re an S Corp, a single-member LLC, or just a sole proprietor, it is still your responsibility to report your gross receipts correctly on your tax return.

When Your LLC or S Corp Receives a Correct 1099-K:

- Include the reported amounts in your gross receipts on your tax return. For Schedule C, use Part 1 of Form 1040. For S Corps, enter gross receipts on Line 1a of Form 1120-S.

- Make sure your gross receipts on the tax return equal or exceed the 1099-K amount. Include other cash inflows like Zelle transfers or check deposits in your gross receipts number. Total gross receipts on your tax return must never be less than the 1099-K amount, as this could trigger an IRS audit.

What If I Received an Incorrect 1099-K?

The first step is to contact the issuer and request a corrected 1099-K. To be honest, good luck with this one. If you are not successful in contacting the payment processing company, don't wait for them—still file your tax return on time (otherwise, you could face a significant non-filing penalty). But you will need to explain the error on your tax return. Here are a couple of scenarios and guidelines on how to resolve this tax issue:

Common 1099-K Errors and How to Fix Them:

1. Wrong Tax Identification Number:

A common problem occurs when a payment processor erroneously issues a 1099-K under your Social Security Number (SSN) instead of the S Corp’s Employer Identification Number (EIN). If the personal return is filed as-is without correcting the error, this can lead to a CP 2000 notice from the IRS, which will tax you personally for that 1099-K.

To resolve this:

- Report the Full 1099-K Amount: Show the entire amount reported on the 1099-K on your personal tax return.

- Deduct the full amount: Deduct the full amount with an explanation that these gross receipts were already accounted under the S-Corp's EIN. This shows the IRS that the income was accounted for by the S Corp and should not be taxed twice.

2. Double Income Situation:

If you used a payment platform for both business and personal transactions or shared the platform with others, the 1099-K will report more income than your business actually earned. This will result in you being taxed on income that isn’t yours.

To resolve this:

- Report the Full 1099-K Amount: Enter the entire amount reported on the 1099-K on your tax return.

- Deduct the Non-Business Portion: Similar to the first scenario, deduct the incorrect amount with an explanation indicating that the reported total includes transactions unrelated to your business.

Tax Pro Tip: Most CPAs will ask their clients for 1099-K forms from all sources. This allows us to reconcile gross receipts before reporting the final number on the tax return. If you prepare your tax return yourself, it’s a good idea to adopt the same habit. This method helps avoid unpleasant CP 2000 notices.

Final Thoughts

The 1099-K form can cause confusion, but understanding its purpose and knowing how to handle it properly on your tax return can help you avoid IRS notices. If you face any issues with a 1099-K, please contact us. We have assisted hundreds of California business with complex tax matters. You are welcome to check out our services here.