Bank reconciliation is essentially the process of comparing your company’s financial records with its bank statements to ensure every transaction matches up. While that sounds straightforward, it doesn’t exactly explain why anyone should spend their time on such a boring task.

Here are a few compelling reasons why bank reconciliations are definitely worth your time.

Reason #1. Accounting Software Setup

Bank reconciliations are necessary because of the way modern accounting software works. Nowdays bank reconciliations have been integrated into accounting software like QuickBooks and Xero. It is impossible to produce financial statements without going through the bank reconciliation process. So, if you paid for accounting software be prepared to learn bank reconciliations.

Reason #2. Financial Clarity For Business Owners

For busibank owners bank reconciliations have multiple benefits. Let's look at a couple of examples.

Example #1: Keeping Track of Revenue

John runs a small retail business. One day, he gets a check from a customer. It's not for a big amount, so he deposits it into the bank and, like many of us, forgets about it. Life gets busy, and John hasn’t reconciled his bank account for months. Meanwhile, the bank refused the check due to the client’s insufficient funds, but John had no idea. In his mind, the customer had paid, and he just went on as usual. His accounting records showed that the payment was made, and he looked like he was doing well.

Fast forward a couple of months with unreconciled transactions, and his profit appears higher than it actually is because of that missing payment. The worst part is that the customer still hasn't paid, but John doesn’t realize this until it's too late to collect the payment. All of this could have been avoided with timely bank reconciliation.

Example #2: Catching Unauthorized Charges.

David’s business card got compromised and had a couple of unauthorized charges on it. Since he isn't in the habit of reconciling his bank accounts, the charges went unnoticed. When David finally discovered the charges, it was too late to do anything since his bank allowed only a certain amount of time to dispute the charges.

Example #3: Correct Cash Projections.

Maria owns a small retail business and buys goods for resale. She does not reconcile her statements on time and misses the fact that some of her inventory purchases were never entered in her books. Maria glances at her inaccurate books and believes that she has a strong profit for the quarter without knowing that her bank account does not have enough cash because the money was spent on unaccounted inventory.

Without a clear picture, Maria's cash flow projection is off, and she moves forward with plans for expansion only to realize that she does not have enough funds to cover necessary day-to-day expenses. Reconciling her accounts on time would have allowed her to adjust her plans and avoid a potentially serious cash shortage.

Why Bank Reconciliations Matter to Tax CPAs ?

Beyond catching errors and proper financials, why do we, tax CPAs, require our clients to do bank reconciliations?

1. Correct Tax Reporting.

If you miss an expense on your books, it means that you are also missing a tax deduction on your tax return. Your revenue gets inflated, and you pay more tax just because you missed that expense on your financial statements. On the other hand, if you miss recording a deposit, you underreport your taxable income, which means you avoided paying taxes on your income, and this could lead to serious consequences with tax authorities.

2. IRS Balance Sheet Requirements.

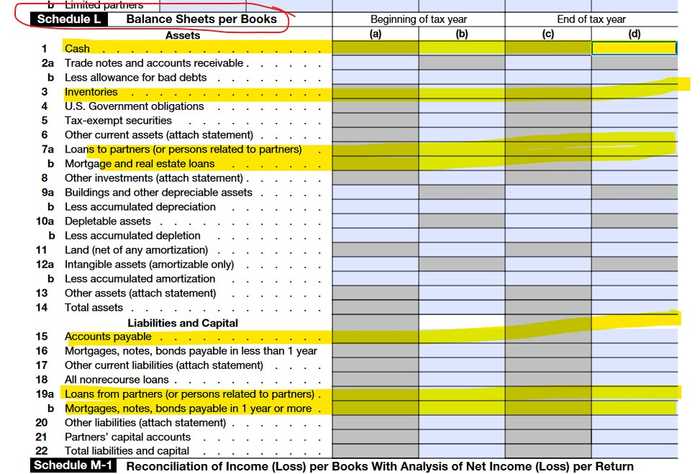

The IRS requires financials for business tax returns, such as forms 1120, 1120S, and 1065, especially if your company’s gross receipts and assets exceed $250,000. The balance sheet on the business tax return (referred to as Schedule L, see an example of it below) shows the ending balances for the year for your cash in bank accounts, other assets, credit cards, accounts payable and so on. The same Schedule L also requests prior year data. The IRS understands how accounting works, and if your bank reconciliations are incorrect, your accounting on Schedule L won't tie in and this may lead to undesired questions from the IRS.

But even with small businesses that do not meet the $250,000 test, bank reconciliations are still required. In simple terms, the IRS needs to know how much money you took out of your business and how much you have contributed to your business, and one of the easiest ways to figure out the exact number of owner contributions and distributions is to conduct a bank reconciliation.

While bank reconciliation are an obvious chore, it is one of the essential practices for your business. It protects you from costly mistakes and ensures you maintain control over your finances. As we’ve seen, skipping this step can lead to duplicated transactions, inflated profits, overpaid taxes, improperly filed tax returns, and missed business opportunities. When you regularly reconcile your accounts, you can catch small errors before they escalate into significant problems.

But what if bank reconciliations are so boring that you don't have enough patience to tackle them? Well, outsource them! At our CPA firm, we offer bank reconciliations as part of our subscription package. If you are a California business owner who struggles with bank reconciliations and taxes, let us know. You are welcome to check out our services here.