Why Choose Us?

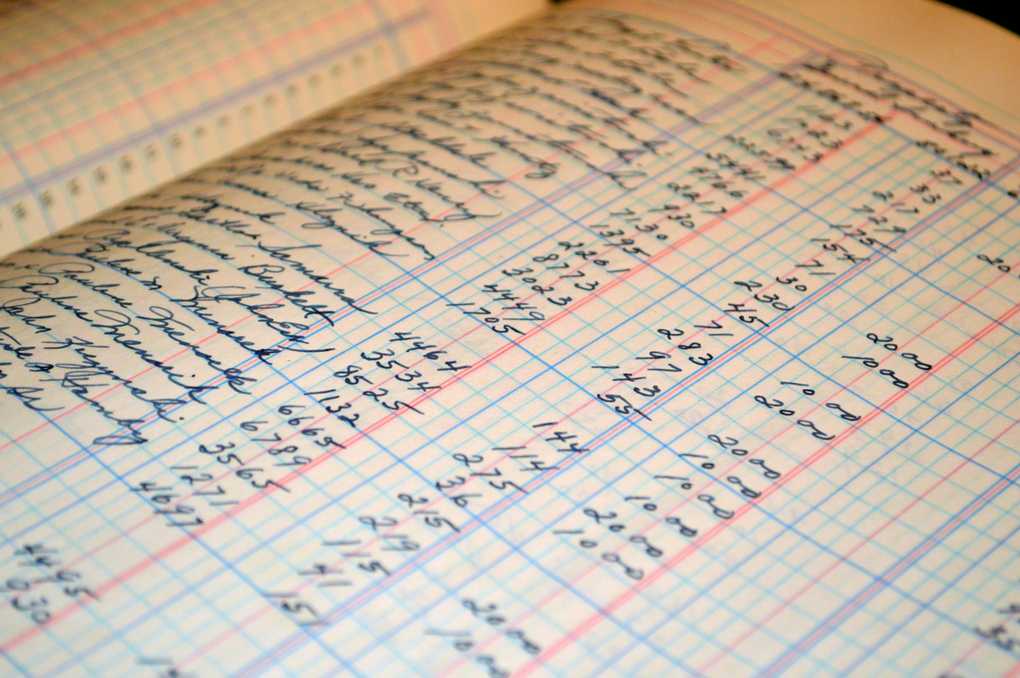

- In short: we’ll take care of your accounting while making sure you are all set tax-wise.

Timely Lock into Tax Planning Strategies.

With our comprehensive accounting services, you not only get accurate financials, but also receive ongoing tax reduction strategies. We work on your tax planning as we do your accounting. Since we are closely involved in your current business endeavors, we jump in and make a tax planning suggestion almost immediately.

Base Your Business Decisions on Solid Financial Data.

We handle your bookkeeping while you're working; your financials are timely, overseen by a CPA and are free from inaccuracies. This allows you to save time and also base your decisions on solid financials. Our proactive support helps you identify accurate profit margins and opportunities for growth, allowing you to focus on the the most profitable areas of your business.

Keep Good Records to Make the IRS Happy.

We also take over categorizing purchases, managing reimbursements, and maintaining supporting documents, ensuring your books are tax audit-proof in case the IRS comes knocking. Our integrated accounting services keep you tax compliant and you don't have to loose your sleep over compliance issues.

- Contact us today for a free consultation and discover how our integrated accounting services can help you make informed business decisions, reduce your tax burden, and maintain tax compliance with ease. Don’t wait—take control of your financial future now!